The L. D. October 21st 2021, n. 146, as modified by the Budget Law 2022, has abrogated the “old” Patent Box and has introduced a new subsidizing regime, the so-called “new Patent Box”, consisting in a “Super deduction” of research and development costs borne for some determinate intangible assets. The regulation’s aim is essentially the same: facilitating enterprises’ investments in some determinate intangible assets, boosting their placement in Italy and promoting research and development (“R&D”) activities aimed at the maintenance and increase of such assets, considered essential to favour the Country’s economic growth. However, the approach is completely different.

While in fact the previous Patent Box was based on a complex tax deduction mechanism for the extra-profit deriving from the exploitation of intangible assets, the new Patent Box is based on a “super-tax deduction” (that is to say, an increase, for the purposes of business income and of IRAP) of R&D costs borne on subsidized intangible assets, which should involve a simpler application.

We shift then from an income-based subsidy (old Patent Box) to a cost-based subsidy (new Patent Box). The new incentive provides for greater tax deductibility of R&D costs related to subsidized intangible assets to the extent of 110%. R&D costs subsidized by the new Patent Box are those costs incurred in carrying out the relevant activities that imply the development, the increase, the maintenance, the protection and the exploitation of subsidized intangible assets, to the ends of the determination of the decrease in taxable income and in the net production value. Subsidized intangible assets are the following: industrial patents, including patents for utility models, legally protected designs and models, software protected by copyright.

These intangible assets can be used directly or indirectly in carrying out the business activity. Therefore, in the first case the owner directly uses the good; in the second case, it is the licensee who acquires from the owner the concession in use of the right to use the intangible asset. In any case, the regulation specifies that only the “investor” subject can benefit from the tax relief, that is to say the subject holding the right to the economic exploitation of subsidized intangible assets, who invests in relevant activities in the ambit of his business activity, bears the relative costs, taking risks and availing himself of eventual results. The investor, in particular, can carry out research and development activities also by means of research contracts signed with companies, universities or research bodies and equivalent organizations.

THE RELEVANT ACTIVITIES MENTIONED IN THE REGULATION OF THE NEW PATENT BOX:- activities that can be classified as industrial research and experimental development;

- activities that can be classified as technological innovation;

- activities that can be classified as design and aesthetical ideation;

- legal protection activities of the rights on intangible assets.

- expenses for the personnel with a subordinate employment, or self-employment or other relationship rather than subordinate employment, directly engaged in the execution of relevant activities;

- depreciation rates, principal amount of financial leasing fee, operating leasing fees and other expenses related to movable capital goods and intangible assets used in the execution of activities;

- expenses for consulting activities;

- expenses for materials, supplies and other analogue products used in activities;

- expenses connected with the maintenance of rights on subsidized intangible assets, upon renewal of the same at the expiry, even in associated form, and those regarding prevention activities of counterfeiting and the management of disputes aimed at protecting the same rights.

- the subsidy can be summed with the tax credit for research and development activities pursuant to Law n. 160/2019;

- the possibility of drawing up suitable documentation is provided for taxpayers, and it allows not being subjected, under certain conditions, to the sanction for unfaithful declaration;

- a particular bonus mechanism is provided.

- the nature of the investor subject, the relationships among enterprises, internal research projects or with independent third parties;

- the identification of intangible assets implemented through research and development activities;

- eventual activities entrusted to independent third parties (“the subject of the contract, the contractual clauses aimed at sharing the risk of failure between client and commission salesman”);

- the subsidized borne expenses referred to each intangible asset;

- the identification of the tax variations that can be directly or indirectly referred to the intangible assets that benefit from subsidy.

- technical projects, aims and “technical and scientific uncertainties it was intended to overcome”;

- how development, protection, maintenance and increase of intangible assets’ value have been implemented.

IN PARTICULAR, THE REGULATION CLARIFIES THAT THE RELEVANT ACTIVITIES, FOR THE PURPOSES OF THE BONUS MECHANISM, ALSO INCLUDE THOSE:

- of fundamental research;

- of ideation and implementation of the software protected by copyright.

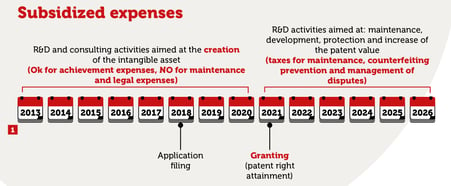

Concerning the relevant expenses for the bonus mechanism, the regulation clarifies they are the same subsidized expenses above-reported, with the exception of those as per item e), and the necessary expenses for the patent right attainment. According to an interpretation of the regulation, which must be still clarified concerning the definition of the “achievement” of a patent right benefitting from subsidy, the scheme under reported exemplifies how the subsidized expenses are calculated in case of a patent right achieved in 2021, against an application filed in 2018.

The regulation intends to facilitate, first of all, the R&D expenses aimed at the maintenance, development, protection and increase of the value of a patent right. In the 5 years of adherence to the regime of the new Patent Box starting from the year in which the patent was obtained, in this case then from 2021 to 2026, it is possible to deduct R&D expenses on the intangible asset subjected to patent, maintenance taxes and the eventual expenses of counterfeiting prevention and management of disputes.

Moreover, the regulation provides for the bonus mechanism, according to which it is possible to recover the expenses that precede the patent achievement, for a time period up to 8 years before. In this case, they are expenses concerning R&D and consulting activities aimed at the creation of the intangible asset.

In particular, it seems that legal consulting expenses for the patent right attainment can be increased. Maintenance expenses instead are not admitted to the increase, nor legal costs for the management of disputes

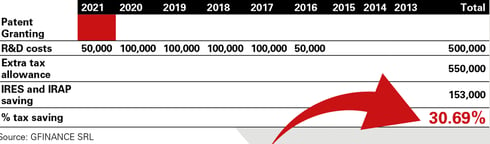

Let us suppose, like in the numerical example under reported, to have achieved a patent in 2021 and to have borne R&D expenses from 2016 to 2021, for 500,000 Euros overall. The extra-tax deduction would then amount to 550,000 Euros. Considering IRES by 24% and IRAP by 3.9%, the tax saving would be equal to 153,450 Euros, for a tax percentage saving amounting to 30.69% (figure 2). Therefore, the investor subject will be entitled to deduct an amount of 210 euros for every 100 Euros of R&D costs that can be referred to a subsidized good, saving, as a result of the increase, 30.69 Euros.

Let us see now briefly the characteristics of main subsidized intangible goods.

Industrial invention patent

It is a new and original solution to a technical problem. After filing, the patent application is subjected to a substantial examination of patentability requirements before being eventually granted. The patent lasts for 20 years and yearly maintenance taxes must be paid starting from the 5th year.

It is a new and original solution to a technical problem. After filing, the patent application is subjected to a substantial examination of patentability requirements before being eventually granted. The patent lasts for 20 years and yearly maintenance taxes must be paid starting from the 5th year.

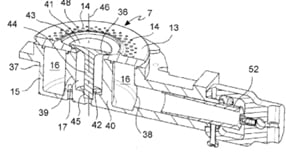

Utility models may be constituted by new apt models for conferring particular efficacy or comfort of application or of use. It has the feature of being granted after an only formal examination. It has a duration of 10 years and needs the payment of a tax for the second quinquennium of life.

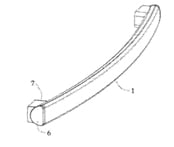

Door handle and dish washing machine

“According to the door handle and the dish-washing machine, the longitudinal section of the door handle body is composed of the multiple arc-shaped curves, so that the door handle is attractive, has a good holding feeling, better conforms to human engineering, and improves the satisfaction degree of customers in use.”

“According to the door handle and the dish-washing machine, the longitudinal section of the door handle body is composed of the multiple arc-shaped curves, so that the door handle is attractive, has a good holding feeling, better conforms to human engineering, and improves the satisfaction degree of customers in use.”

Design or model registration

It concerns the look of an entire product or of one of its parts, provided that it is new and provided with individual character.

It concerns the look of an entire product or of one of its parts, provided that it is new and provided with individual character.

In the European registration system, the registration occurs very quickly, after a purely formal examination of the application. It lasts for 25 years, renewable five by five. More models can be included in the same application, provided they belong to the same typology.

It is worth noticing that it seems to be included among subsidized intangible goods also the so-called unregistered community design or model, whose protection has a duration of three years starting from the first making the design or the model available for the public, to keep the European Union’s interested environments reasonably informed. Therefore, it is a title that does not need a formal registration.

Software protected by copyright

For “software protected by copyright” are meant “the programmes for computer, expressed in whatever form, provided they are original, as result of the author’s intellectual creation”.

It is an intangible good of particular interest, especially for the companies that operate in the electronics and automation sector. More and more frequently, in fact, the software constitutes an element of real innovation in a product, device or process. Therefore, not only the so-called “software houses” can benefit from the Patent Box relief, but whatever subject that, internally or externally, develops software and/or software applications provided with a certain level of originality (as hereunder explained).

Let us think, for instance, of all applications connected with the IoT (Internet of Things), artificial intelligence, the app market or, in general, the delivery of remote functions or services.

To achieve the protection required by the Patent Box discipline, no formal registration seems to be necessary, since the programme, if provided with originality, has been protected by the copyright since its creation time. However, it is possible and advisable to provide for the programme filing at the Public Software Register held by SIAE, especially to highlight the paternity and the creation date of the work.

Concerning the character of software originality and innovation, jurisprudence has established that “creativity and originality subsist even when the work is composed by simple ideas and notions, included in the intellectual heritage of people who have expertise in the matter of the work itself, provided that they are formulated and organized in personal and autonomous manner compared to previous ones”. Moreover, “a computer programme can be characterized by innovation and originality, since its creator has adapted the typical applicative architecture to the case and to the specific technological environment. Therefore, it derives that the specificity of a software programme, which anyway features a base architecture shared by other systems, resides in the capability of adapting the applicative architecture to the case and to the specific technological environment.”

Therefore, the originality level to gain access to the copyright is, actually, quite modest. The consequence is that whoever bears costs to develop a software application autonomously or also to adapt existing software to a specific application or to a specific technological environment can take advantage of the tax reliefs of the new Patent Box.

Conclusive remarks

The new Patent Box certainly constitutes a very interesting tax relief as it allows obtaining, for whatever enterprise that bears research and development expenses, a relevant tax saving with a notably simplified procedure compared to the previous Patent Box regime.

From the strategic point of view, besides obviously assessing attentively the correspondence between expenses borne (both before and after the patent attainment) and the intangible good that can be actually subsidized, to shorten the times for the tax relief attainment and to optimize its scope we might consider:

- the filing of Utility Models (even at the same time as the invention patent), to take advantage of the automatic granting procedure;

- the combination of the functional protection (patent) with the aesthetic protection (design or model, even if not registered), to have, also in this case, immediately and rapidly attainable intangible goods;

- software protected by copyright.